Thinking about the future is acting Now

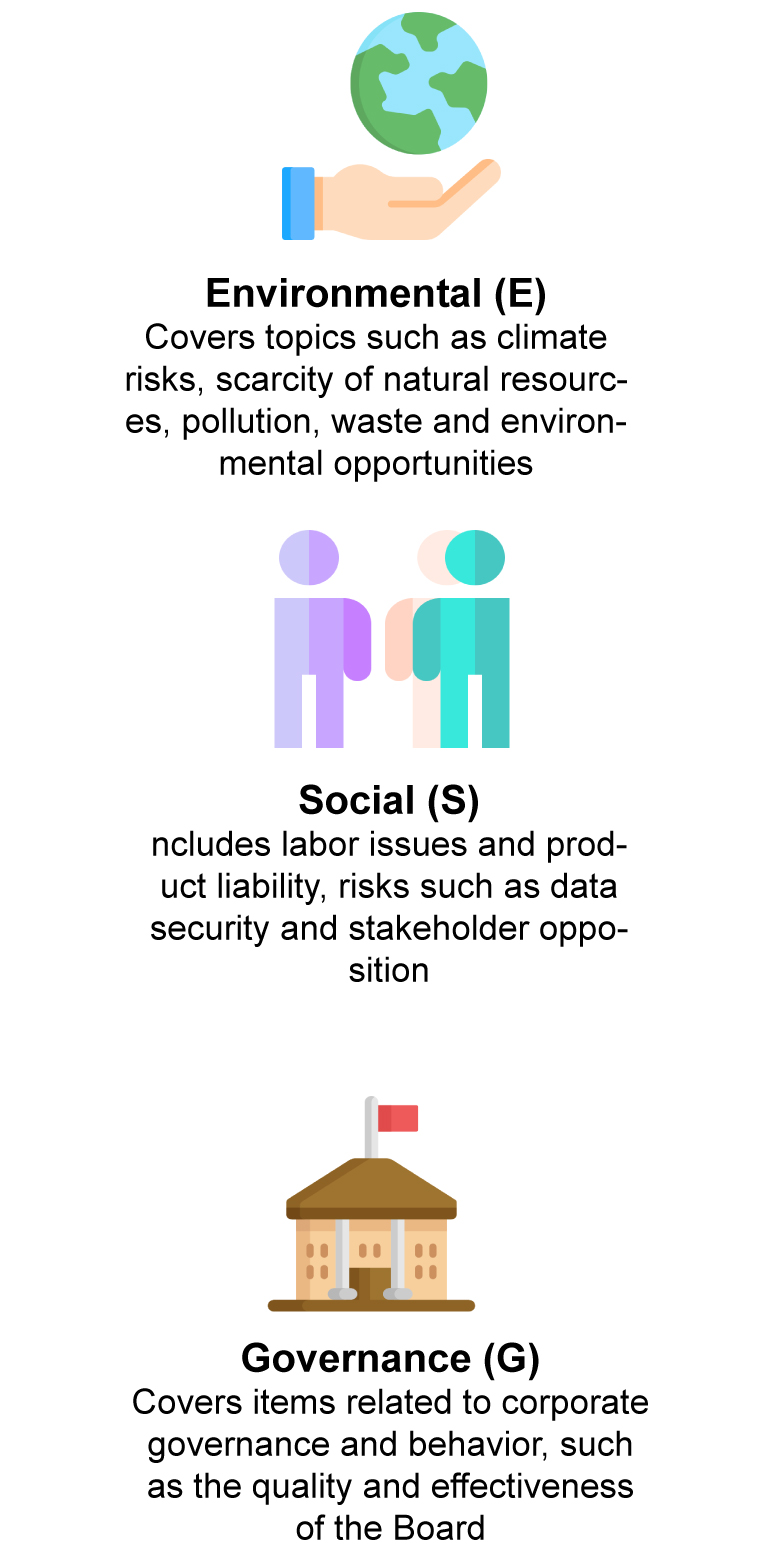

Banco Finantia governs its day-to-day activities based on sustainable responsibility, inclusion, respect, innovation, concern for the environment and mutual help. It recognizes that environmental, social and governance issues (ESG) pose major challenges to the long-term prosperity of the global economy, the well-being of people and society, and the regeneration capacity of the natural environment and that it impacts performance long-term business.

The work carried out by the Intergovernmental Group on Climate Change has been the foundation of international agreements, such as the Paris Agreement, to fight the effects of climate change and to support the transition to a sustainable society.

|

|

|

|

|

Banco Finantia is therefore committed to supporting its customers and the economy in their transition to a sustainable economy, making known financial products and/or services from business activities that are environmentally and socially responsible, combining good long-term performance with social fairness and environmental protection, in line with its sustainability commitments.

Sustainability is about Building, Thinking of the future

Sustainability issues can have a favorable effect on contributing to a company's long-term financial performance and contribute to further economic, social and environmentally sustainable progress. Thus, incorporating these considerations into the investment research, portfolio construction, portfolio review, and direction processes of portfolio managers can help improve long-term risk-adjusted returns by making investment decisions that take financially into account ESG’s information relevant. It also pays special attention to the issues of worker's health, safety and human rights and the impact on local communities.

What is Sustainable Investment?

What is the SFDR Regulation?

Sustainability and climate risks

Venture capital. All financial investments carry an element of risk. Therefore, the value of the investment and the income resulting from it will vary and the amount of the initial investment cannot be guaranteed. In other words, every investment is associated with an expectation of return based on its level of risk: the greater the expected return, the greater the level of risk being assumed. Past performance is not a reliable indicator of current or future results and should not be the only consideration when selecting a product or strategy. Changes in exchange rates between currencies may cause the value of investments to decrease or increase. The fluctuation can be particularly pronounced in the case of a fund with greater volatility and the value of an investment can drop sharply and substantially. Tax levels and base may change from time to time.

Climatic Risks: is the possible negative impact that a climatic event can cause to a good, society or ecosystem. It is not necessarily physical and caused only by climate change, it may be associated with other aspects such as transition.

Transition risks: those that appear on the path to a sustainable economy which can be: regulatory, legal, technological, market or reputational..

Legal risks: correspond to legal proceedings that organizations may suffer for inadequate management of climate impacts on the communities in which they operate.

Technological risk: the need to incorporate new technologies into production processes also contributes to climate risk, given its potential to affect competitiveness and production costs.

Reputation risk: the need to properly integrate ESG aspects into the Entity's strategy, specifically in the management of client and investment portfolios.

Operational risk: losses in the event of incorrect advice from an Entity, or in the absence of an assessment of sustainability risks that may affect it.

Your Private Banker will be happy to organize a more detailed meeting about the opportunity presented by sustainable investment.

For more information, please see here the Policy on Integration of Sustainability Risks in Customer Financial Services.